Funding without the fuss

- Tailored financial solutions to help your business.

- Access to extra capital you need quickly and easily.

- Our dedicated expert team will talk you through your options.

Check your eligibility right now: no credit searches or personal information required.

Origin Finance

We’ve packed our team full of knowledgeable, approachable people who are in the industry for the right reason: to help businesses like yours.

Get A Quote

Our team is full of knowledgeable, approachable people who are in the industry for the right reason.

Get In Touch

Eligibility Checker

Find out whether you’re eligible for our funding solutions. We don’t need any personal info from you - just some essentials.

Get In Touch

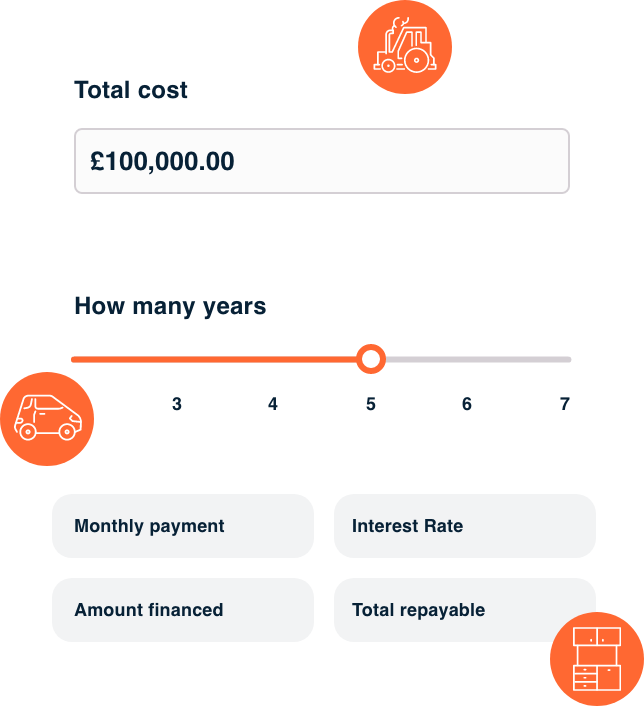

Calculators

Calculate repayment costs based on your specific requirements. No personal information is required.

Get In Touch

Finance Options

We offer a range of finance options designed to support your business growth and make accessing funding simple and hassle-free. Whether you need capital to invest in new opportunities or acquire essential assets, we have the right solution for you.

Asset Finance

Asset finance can be used to fund tangible and intangible assets, and encompasses an array of agreement types including hire purchase, finance lease and operating lease.

- Access to over 120 lenders from high street banks to niche providers

- Experienced dedicated Account Manager as your sole point of contact

- Asset finance rates start from 3.40% and terms up to seven years

Invoice Finance

Invoice finance allows businesses to convert any unpaid invoices into working capital. It is strictly for invoices addressed to businesses.

- Access to over 30 lenders from high street banks to niche providers

- Experienced dedicated Account Manager as your sole point of contact

- Facilities tailored to individual needs, many with discreet payment terms

Refinance

Refinance allows companies to release working capital from assets they already own, whilst continuing to use them as normal. Rates are often lower than business loans.

- Access to over 50 specialist refinance lenders including niche providers

- Experienced dedicated Account Manager as your sole point of contact

- Refinance rates start from 4.15% and terms up to seven years

Business Loans

Business loans offer great flexibility. Funds are paid directly into your business’ bank account and can then be used however you see fit.

- Access to over 120 lenders from high street banks to niche providers

- Experienced dedicated Account Manager as your sole point of contact

- Business Loan rates start from 5.99% and terms up to seven years

Growth Guarantee Scheme

The Growth Guarantee Scheme (GGS) is a Government-backed lending scheme and is the successor to the Recovery Loan Scheme (RLS).

- Access to over 35 growth guarantee scheme accredited lenders

- Experienced dedicated Account Manager as your sole point of contact

- GGS rates start from 3.60% and terms up to seven years

ABOUT ORIGIN

We do things differently

Our team is made up of commercial finance veterans, each with a glittering background. What matters the most to us is ensuring that our customers get the most suitable finance package to enable them to grow and that their experience with us is second to none.

Our Mission

To change how business finance is perceived by UK SMEs. Businesses need the support of real people, not computer algorithms.

Our Approach

To educate rather than sell. Whether we do business with a customer or not, we want to leave them in a more knowledgeable position.

Our Promise

To remain true to our core values by helping businesses understand what finance option is available to them in a clear & upfront manner.

Why use a finance broker?

When applying for car insurance to ensure you’re getting the best price on the market right now, you use a price comparison site, such as GoCompare or Compare The Market. These well-known sites are in fact insurance brokers. So why not use a broker when it comes to arranging finance for your business?